- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, ft professional, weekend print + standard digital, weekend print + premium digital.

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Global news & analysis

- Exclusive FT analysis

- FT App on Android & iOS

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

- 20 monthly gift articles to share

- Lex: FT's flagship investment column

- 15+ Premium newsletters by leading experts

- FT Digital Edition: our digitised print edition

- Weekday Print Edition

- Videos & Podcasts

- Premium newsletters

- 10 additional gift articles per month

- FT Weekend Print delivery

- Everything in Standard Digital

- Everything in Premium Digital

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

- 10 monthly gift articles to share

- Everything in Print

- Make and share highlights

- FT Workspace

- Markets data widget

- Subscription Manager

- Workflow integrations

- Occasional readers go free

- Volume discount

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

About / Departments

Finance Department | PhD Program

Phd program.

Our faculty, ranked #1 worldwide based on publications in top finance journals (ASU Finance Rankings), consists of more than 30 researchers who study all major areas of finance, making it one of the largest finance faculty in the country. Stern’s finance faculty is highly rated in terms of research output, and faculty members sit on the editorial boards of all major finance journals.

The finance department offers an exceptionally large range of courses devoted exclusively to PhD students. Apart from core PhD courses in asset pricing and corporate finance, students can choose from a range of electives such as household finance, macro-finance, and financial intermediation. PhD students also enjoy the benefits of Stern’s economics department, NYU’s economics department in the Graduate School of Arts and Science (GSAS), and the Courant Institute of Mathematics.

Graduates of Stern’s Finance PhD program have been placed at leading research institutions such as Harvard, MIT, Chicago, Stanford, Wharton, Yale, and UCLA.

Holger Mueller , Finance PhD coordinator

More information on the Finance PhD

Download the Finance PhD poster (PDF)

Explore Stern PhD

- Meet with Us

Smart. Open. Grounded. Inventive. Read our Ideas Made to Matter.

Which program is right for you?

Through intellectual rigor and experiential learning, this full-time, two-year MBA program develops leaders who make a difference in the world.

A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers.

A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems.

Earn your MBA and SM in engineering with this transformative two-year program.

Combine an international MBA with a deep dive into management science. A special opportunity for partner and affiliate schools only.

A doctoral program that produces outstanding scholars who are leading in their fields of research.

Bring a business perspective to your technical and quantitative expertise with a bachelor’s degree in management, business analytics, or finance.

A joint program for mid-career professionals that integrates engineering and systems thinking. Earn your master’s degree in engineering and management.

An interdisciplinary program that combines engineering, management, and design, leading to a master’s degree in engineering and management.

Executive Programs

A full-time MBA program for mid-career leaders eager to dedicate one year of discovery for a lifetime of impact.

This 20-month MBA program equips experienced executives to enhance their impact on their organizations and the world.

Non-degree programs for senior executives and high-potential managers.

A non-degree, customizable program for mid-career professionals.

PhD Program in Finance

2023-24 curriculum outline.

The MIT Sloan Finance Group offers a doctoral program specialization in Finance for students interested in research careers in academic finance. The requirements of the program may be loosely divided into five categories: coursework, the Finance Seminar, the general examination, the research paper, and the dissertation. Attendance at the weekly Finance Seminar is mandatory in the second year and beyond and is encouraged in the first year. During the first two years, students are engaged primarily in coursework, taking both required and elective courses in preparation for their general examination at the end of the second year. Students are required to complete a research paper by the end of their fifth semester, present it in front of the faculty committee and receive a passing grade. After that, students are required to find a formal thesis advisor and form a thesis committee by the end of their eighth semester. The Thesis Committee should consist of at least one tenured faculty from the MIT Sloan Finance Group.

Required Courses

The following set of required courses is designed to furnish each student with a sound and well-rounded understanding of the theoretical and empirical foundations of finance, as well as the tools necessary to make original contributions in each of these areas. Finance PhD courses (15.470, 15.471, 15.472, 15.473, 15.474) in which the student does not receive a grade of B or higher must be retaken.

First Year - Summer

Math Camp begins on the second Monday in August.

First Year - Fall Semester

14.121/14.122 Micro Theory I/II

14.451/14.452 Macro Theory I/II ( strongly recommended)

14.380/14.381 — Statistics/Applied Econometrics

15.470 — Asset Pricing

First Year - Spring Semester

14.123/14.124 Micro Theory III/IV

14.453/14.454 Macro Theory III/IV (strongly recommended)

14.382 – Econometrics

15.471 – Corporate Finance

Second Year - Fall Semester

15.472 — Advanced Asset Pricing

14.384 — Time-Series Analysis or 14.385 — Nonlinear Econometric Analysis (Enrolled students receive a one-semester waiver from attending the Finance Seminar due to a scheduling conflict)

15.475 — Current Research in Financial Economics

Second Year - Spring Semester

15.473 — Advanced Corporate Finance

15.474 — Current Topics in Finance (strongly encouraged to take multiple times)

15.475 — Current Research in Financial Economics

Recommended Elective Courses

Beyond these required courses, students are expected to enroll in elective courses determined by their primary area of interest. There are two informal “tracks” in Financial Economics: Corporate Finance and Asset Pricing. Recommended electives are designed to deepen the student's grasp of material that will be central to the writing of his/her dissertation. Students also have the opportunity to take courses at Harvard University. There is no formal requirement to select one track or another, and students are free to take any of the electives.

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets & Trade

- Operations & Logistics

- Opportunity & Access

- Organizational Behavior

- Political Economy

- Social Impact

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Services

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Entering Class Profile

- Education & CV

- GMAT & GRE

- International Applicants

- Statement of Purpose

- Letters of Recommendation

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Fields of Study

- Student Life

Finance Requirements

I. preparation.

The study of financial economics requires a grasp of several types of basic mathematics. Students must enter with or very quickly acquire knowledge of the concepts and techniques of:

It is strongly advised that students without a strong and recent background in calculus, linear algebra, or statistics come to Stanford in June to take courses to strengthen any weak areas.

Computer programming skills are necessary in coursework (as early as the first quarter of the first year) and in research. If students do not have adequate computer programming skills, they may wish to take a computer programming course before they arrive at Stanford, or take an appropriate Stanford computer science course while here.

II. Course Requirements

All required courses must be taken for a grade (not pass/fail or credit/no credit). Exceptions are made if the required course is offered pass/fail or credit/no credit only. Each course must be passed with a grade of P or B- or better. Substitutions of required courses require approval from the faculty liaison. Waiving a course requirement based on similar doctoral level course completed elsewhere requires the approval of the course instructor, faculty liaison, and the PhD Program Office.

III. Practicum

Students are required to sign up for either a research or teaching practicum each quarter of enrollment. Below is a description of the practicum requirements for Finance students.

During the student’s first year, the student will be assigned each quarter to work with a different faculty member. This assignment will involve mentoring and advising from the faculty member and RA work from the student. The purpose of new assignments each quarter is to give the student exposure to a number of different faculty members.

In subsequent years, the practicum will take the form of a research or teaching mentorship, where the student is expected to provide research or teaching support under the guidance and advice of a faculty member. Faculty assignments here will be made through informal discussions between faculty and students, and may be quarterly, or for the entire year.

For students of all years, one requirement to satisfy the practicum is that students regularly attend the Finance seminar. The only exception to this will be if there is a direct and unavoidable conflict between the seminar and necessary coursework.

IV. Summer Research Papers

All students in all years are expected to complete a research paper over the summer, and present this paper in the Fall quarter. A draft of this research paper should be submitted by the end of September to the field liaison. Students can continue to work on and improve their paper up to their presentation.

For students completing their first year, the summer paper should demonstrate the mastery of a specific area in the literature together with the early development of a research idea in this area. The student will be expected to present this paper to a gathering of three Finance faculty members of the student’s choosing in October.

In all years after the first year, the summer research paper should be a well-developed research paper. (Well-developed does not mean completed – research is always presented as work in progress. Rather, it means that the work shows enough progress and development to merit a seminar presentation.) Students will then present their papers to the overall Finance faculty and PhD student body in scheduled talks over the Fall quarter. Student presentations will typically be 45 minutes, save for job market paper presentations, which will be a full hour and a half.

A passing grade on the paper at the end of the second year is one requirement for admission to candidacy. More generally, these presentations throughout all years will be a primary manner that faculty who are not advising the student become familiar with the student’s work, and will play a crucial role in the assessment of the student’s academic progress.

V. Field Exam

Students take the field exam in the summer after the first year. Material from the field exam will be based on required first year coursework. This includes required finance courses, as well as the required microeconomic and econometric classes. The primary purpose of the exam is to ascertain that students have learned the introductory material that is a necessary foundation for understanding and undertaking research in the field. Additionally, studying for the field exam will give students the opportunity to review and synthesize material across all their different first year courses. Students may be asked to leave the program if they fail the field exam, or may be allowed to retake the exam at the Faculty’s discretion. Students who fail the field exam two times will be required to leave the program.

VI. Teaching Requirement

One quarter of course assistantship or teaching practicum. This requirement must be completed prior to graduation.

VII. Finance Oral Exam

The finance oral exam takes place at the end of the spring quarter of the second year, in early June.

At the beginning of the spring quarter of the second year, the student meets with the liaison to determine three finance faculty members who will administer the exam. The student then meets with the selected faculty examiners to discuss a set of topics that will be covered in the finance oral exam. These topics will generally be chosen from coverage in the Finance PhD classes. An important component of the exam involves the student identifying a particular research area to discuss at the exam. The student will be expected to discuss major results in the literature related to this area and to identify important unresolved questions that need to be addressed. In addition the student will be expected to discuss how one or more of these questions might be addressed either theoretically or empirically. This discussion can be viewed as a preliminary step towards identifying the research project of the second year paper. The results from the finance oral exam plus the result from the second-year summer research paper (presented in the fall of 3rd year) and overall performance in the program are weighed in the decision to admit to candidacy.

VIII. Candidacy

Admission to candidacy for the doctoral degree is a judgment by the faculty of the student’s potential to successfully complete the requirements of the degree program. Students are required to advance to candidacy by September 1 before the start of their fourth year in the program.

IX. University Oral Exam

The university oral examination is a defense of the dissertation work in progress. The student orally presents and defends the thesis work in progress at a stage when it is one-half to two-thirds complete. The oral examination committee tests the student on the theory and methodology underlying the research, the areas of application and portions of the major field to which the research is relevant, and the significance of the dissertation research. Students are required to successfully complete the oral exams by September 1 before the start of their fifth year in the program.

X. Doctoral Dissertation

The doctoral dissertation is expected to be an original contribution to scholarship or scientific knowledge, to exemplify the highest standards of the discipline, and to be of lasting value to the intellectual community. The Finance faculty defer to the student’s Dissertation Reading Committee to provide general guidelines (e.g., number of chapters, length of dissertation) on the dissertation.

Typical Timeline

Years one & two.

- Field Requirements

- Directed Reading & Research

- Advancement to Candidacy

- Formulation of Research Topic

- Annual Evaluation

- Continued Research

Stanford University

Related departments.

- Priorities for the GSB's Future

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Teaching & Curriculum

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Certificate & Award Recipients

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Business Transformation

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships and Prizes

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Get Involved

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- Career Advancement

- Career Change

- How You Will Learn

- Admission Events

- Personal Information

- Information for Recommenders

- GMAT, GRE & EA

- English Proficiency Tests

- After You’re Admitted

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Operations, Information & Technology

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- Videos, Code & Data

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Reading Materials

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Other Industries Forum OTH

Why Do a Ph.D in Finance?

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share via Email

As a sophomore undergrad, how can I best position myself to get into a good Ph.D. program? I plan on doing a masters beforehand, and I was wondering if it would be in my best interest to seek out work experience prior to applying to Ph.D. programs or if I should just do research and work towards publications at my University (which is a top 25 school).

What are the requirements for a Top 25 Ph.D. in Finance?

Getting into a top Ph.D. in Finance program is extremely competitive. A firm foundation in math is essential as is economics. To set yourself apart, a letter from a well-published professor is going to give you an edge. If you can get yourself an internship with this professor, even better.

Any and all experience you can get prior to your Ph.D. application will be useful. The most effective approach is getting published in a top finance publication, however with the limited research knowledge and experience received in an undergrad, this can prove difficult.

Finance related work experience and internships are valuable as they display your dedication and work ethic but they are not likely going to be enough for your Ph.D. application. What they will do is give you a better of an idea what a career in finance would be like and if you would prefer to be in a bank/corporate setting or academia post-graduation.

Finance Ph.D. Ranking

Take a look at some of the top-ranked business schools according to Bloomberg

teenagepirate: Top finance Ph.Ds are more competitive than any entry-level job within banking. A publication always helps. Research experience helps more than internships but competitive internships (top name bank etc.) have value because they're a signal that you're capable of working hard. Admission to the top 25 schools is essentially a lottery. Average GMAT for Chicago's finance Ph.D. was 760+ for instance. Work hard, do your math courses, do your economic courses, get good recommendation letters from well-published finance profs (try to do research internships with them). Independent research won't get you very far because as an undergrad, you're just not trained well enough to do it to a high level.

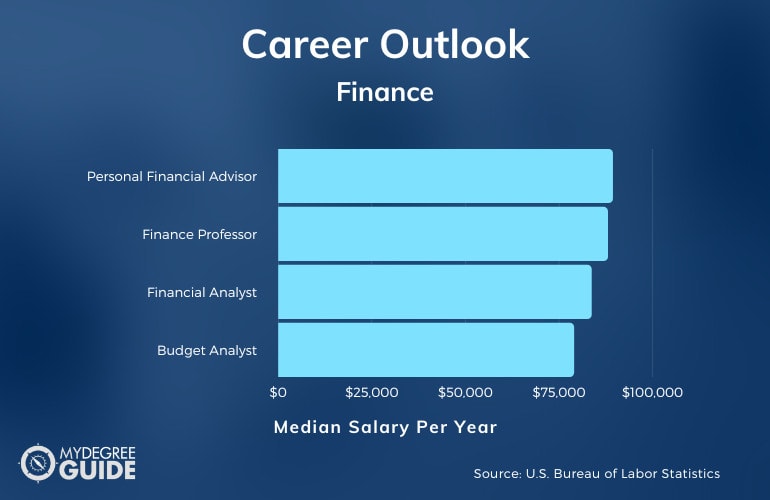

What do Finance Ph.Ds do after Graduating?

A Ph.D. in Finance will set you up for a position at a quantitive trading desk. They land fewer jobs with I-banks and more often work behind the scenes and are generally less involved directly with clients as their reputation tends to be that they are more academic and less business oriented. What it does set you up for, however, is a career in academia as a professor or researcher.

Schumacher: I-banks generally have economists and market strategists (not sure who gets these jobs and how) that generally most of these people carry PhDs. The trend at most quant trading desks seems to lean more towards the physics, mathematics, statistics PhDs. It's a great degree to have if you want to break into trading. To be honest, a Finance Ph.D. is basically only beneficial to people who want to become college professors, which has its perks (ridiculously short hours, low-stress environment, and great pay assuming you can get a job at a half-decent college).

https://www.youtube.com/watch?v=tnn4Ny67DY4

UES802: I was talking a bit ago with an MD at an MM I-bank and someone asked him a similar question. He responded with, while anything is possible, attaining a Ph.D. in Finance won't really help your chances to get into I-banking all that much. He personally felt that people who go this route tend to get too used to the culture and routine that is involved with school, and are better equipped to become a professor than to attempt to enter the business world.

Academic-based positions can be extremely lucrative and appealing due to the great benefits and hours but if you’re keen to work with clients and in the front end of things, it would probably be more book education than you need.

Read More about Finance Ph.Ds at Wall Street Oasis

- Ph.D. Yah or Nah?

- Finance Ph.D. vs. Finance MBA

- Any Value to a Summer Internship before doing a Ph.DProgram?

Decided to Pursue a Wall Street Career? Learn How to Network like a Master.

Inside the WSO Finance networking guide, you'll get a comprehensive, all-inclusive roadmap for maximizing your networking efforts (and minimizing embarrassing blunders). This info-rich book is packed with 71 pages of detailed strategies to help you get the most of your networking, including cold emailing templates, questions to ask in interviews, and action steps for success in navigating the Wall Street networking process.

Networking Guide

It's fairly difficult. Princeton admits 1-2 PhDs each year. Same with the other top ten schools.

My advice is to write a paper that gets published in a Big Three journal (Journal of Finance, Journal of Financial Economics, Review of Financial Studies.) If you can do that, you should get in just about anywhere.

IlliniProgrammer: It's fairly difficult. Princeton admits 1-2 PhDs each year. Same with the other top ten schools. My advice is to write a paper that gets published in a Big Three journal (Journal of Finance, Journal of Financial Economics, Review of Financial Studies.) If you can do that, you should get in just about anywhere.

Wow, are non-ivies (say, top 30 schools) a little easier? How about a publication in a good health economics journal? (I hope to get more involved in healthcare finance research)

Would my undergrad summers best be utilized by doing research or internships at F500 or investment banks ?

Top finance PhDs are more competitive than any entry level job within banking. A publication always helps. Research experience helps more than internships but competitive internships (top name bank etc.) have value because they're a signal that you're capable of working hard.

Admission to the top 25 schools is essentially a lottery. Average GMAT for Chicago's finance PhD was 760+ for instance. Work hard, do your math courses, do your econ courses, get good recommendation letters from well published finance profs (try to do research internships with them). Independent research won't get you very far because as an undergrad, you're just not trained well enough to do it to a high level.

Finally, don't post here, post on urch.com and read econjobrumors.com . People here are a little bit retarded and think a PhD is something you do if you don't get a job and you want to be lazy. A finance assistant prof (ie straight out of PhD) at a top 25 school will get $200k+ for 9 months a year and a professorial lifestyle. Hell, even PhD students get a $30k stipend (and can raise external financing for the program). It's not as much as you get paid in industry, but it's pretty excellent when you consider the lifestyle and the fact that you don't have to wade through as much bullcrap in your career.

teenagepirate: IlliniProgrammer: It's fairly difficult. Princeton admits 1-2 PhDs each year. Same with the other top ten schools. My advice is to write a paper that gets published in a Big Three journal (Journal of Finance, Journal of Financial Economics, Review of Financial Studies.) If you can do that, you should get in just about anywhere.

How are the results for attending a program outside the top 30 or even top 50? Does it get increasingly tough to get tenure and industry opportunities?

Also, I was on academic probation during my freshman year due to poor grades. If I bounce back to about a 3.7 GPA or so by time of application, would it come back to bite me?

Thank you for your response, it helped greatly!

Between Harrison Hong, Markus Brunnermeier, and Ben Bernanke, we have our fair share of research on the financial markets.

Everyone has access to WRDS; everyone can crank out an analysis and figure out if there's something publishable in about a week's time; and the papers are examined blindly. This is something any 21 year old with Excel and WRDS can do; it's not exactly like this is 1978 and some 18 year old is trying to invent the PC in his parents' California garage. (Oh wait.)

Ask a tough question for which there is financial or economic data to answer it with. Then find an appropriate journal to submit your analysis to. They don't really consider the fact that you're an undergrad until the decision to publish has already been made.

Get something published- just make sure you have something really interesting. The JoF's submission fee is something like $250 and they have a twelve week turnaround time.

just u are, idiots

just ure retarded

The market is very good, solid 6 figure salaries for starting associate professors. Pretty much everything you read about getting into economics PhD programs can be cross applied to finance PhD programs. The most improtant things are going to be:

- Math background: math stats, probability, differential equations, and real analysis would be very good.

- Recs from profs

- Experience working as a research assistant, writing a senior thesis, etc. These are the sorts of things that make for good recs.

- A non disqualifying GRE quant score (as close to 800 as possible).

Also look into econ PhDs where you can concentrate in financial economics. They won't care about interning at a F500 or whatever, it's irrelevant.

(the reason I mentioned Etula there in the last paragraph is not because he's a retard or anything but because his asset pricing paper was mentioned on Falkenblog yesterday http://falkenblog.blogspot.com/2013/01/is-broker-dealer-leverage-elusiv… and I really wasn't convinced by it yet this guy is an "asset pricing expert" in QIS at GSAM )

teenagepirate: (the reason I mentioned Etula there in the last paragraph is not because he's a retard or anything but because his asset pricing paper was mentioned on Falkenblog yesterday http://falkenblog.blogspot.com/2013/01/is-broker-dealer-leverage-elusiv… and I really wasn't convinced by it yet this guy is an "asset pricing expert" in QIS at GSAM )

How difficult is getting into an accounting phd program? What undergrad/ MS concentrations would set me up best for this and/or finance?

jackd9999: teenagepirate: (the reason I mentioned Etula there in the last paragraph is not because he's a retard or anything but because his asset pricing paper was mentioned on Falkenblog yesterday http://falkenblog.blogspot.com/2013/01/is-broker-dealer-leverage-elusiv… and I really wasn't convinced by it yet this guy is an "asset pricing expert" in QIS at GSAM )

As for your undergrad, it's not super important. Undergraduate accounting tends to be way more practical than what research is. Your best bets are math, econ, statistics and finance, with a few accounting courses so that you understand the very basic concepts. After those come engineering, physics etc. Essentially, you just need to be able to show that you can handle the very quantitative courseload. Often, you'll need to have done a few basic courses in micro-economics and finance, but this is not a hard requirement at all schools. Some schools (Stanford comes to mind, MIT too I think) also require some programming proficiency so it makes sense to do a bit of compsci as well.

And are you serious about "everyone can crank out an analysis and figure out it there's something publishable"? It takes Hong, Brunnermeier etc. a year or so to go from idea to publication and that's with an army of research assistants and co-authors. It's virtually impossible for an undergrad to know the established methodologies for a given field, to know whether their question is relevant and to be able to write the paper in the right way to get their point across in a way that's acceptable to the editors. An undergrad is not going to get a top 3 pub in econ/acc/fin, they may get their dissertation in if their supervisor puts a lot of work into it, but I've never seen a BSc diss make it, only masters level ones. And, as I said, the supervisor usually helps a lot with that.

If you have a trading strategy that can generate a big enough sharpe ratio, it's not too tough to get it published in the JQFA. And if it's big enough and obvious enough to raise a lot of doubt about the EMH or CAPM , you're now talking about a big three publication.

You can vet a trading strategy in about three days in industry. It took me a week to come up with something that can consistently generate a Sharpe of 2.

Most of the quants who held Finance PhDs I worked with in industry were published multiple times in grad school. Seriously, it's not all that tough. And it doesn't really matter your school's ranking- it matters what you, personally get published. Attending a school with a brand name can also be helpful, but you're only the sum of your work product.

Bottom line: If you want into grad school, get something published .

IlliniProgrammer: And are you serious about "everyone can crank out an analysis and figure out it there's something publishable"? It takes Hong, Brunnermeier etc. a year or so to go from idea to publication and that's with an army of research assistants and co-authors. It's virtually impossible for an undergrad to know the established methodologies for a given field, to know whether their question is relevant and to be able to write the paper in the right way to get their point across in a way that's acceptable to the editors. An undergrad is not going to get a top 3 pub in econ/acc/fin, they may get their dissertation in if their supervisor puts a lot of work into it, but I've never seen a BSc diss make it, only masters level ones. And, as I said, the supervisor usually helps a lot with that.

You can vet a trading strategy in about three days in industry; probably less. It took me a week to come up with something that can consistently generate a Sharpe of 2.

Just randomly picked 3 top 10 schools that showed CVs of their current students / job market candidates. Most of them have no publications, a few have one paper with a supervisor or something. You don't get a top 3 publication for figuring out a trading rule, you don't even get a JPM or FAJ for that. No one cares, it's probably the result of data mining or ignoring something like liquidity/ trading costs etc..

And what do you mean by quant? You mean someone working derivs, or a quant as in someone who specializes in quantitative investing? Basically mathematical finance vs. asset pricing? Because in mathematics and physics it's a lot easier to publish than in finance, articles are much shorter and take less time to get through.

If getting a top journal publication was easy, leading professors wouldn't travel half-way around the world to present papers at seminars and get comments on them.

teenagepirate: IlliniProgrammer: And are you serious about "everyone can crank out an analysis and figure out it there's something publishable"? It takes Hong, Brunnermeier etc. a year or so to go from idea to publication and that's with an army of research assistants and co-authors. It's virtually impossible for an undergrad to know the established methodologies for a given field, to know whether their question is relevant and to be able to write the paper in the right way to get their point across in a way that's acceptable to the editors. An undergrad is not going to get a top 3 pub in econ/acc/fin, they may get their dissertation in if their supervisor puts a lot of work into it, but I've never seen a BSc diss make it, only masters level ones. And, as I said, the supervisor usually helps a lot with that.

Uncovering Hedge Fund Skill from The Portfolio Holdings They Hide This paper studies the “confidential holdings” of institutional investors, especially hedge funds, where the quarter‐end equity holdings are disclosed with a delay through amendments to Form 13F and are usually excluded from the standard databases. Funds managing large risky portfolios with nonconventional strategies seek confidentiality more frequently. Stocks in these holdings are disproportionately associated with information‐sensitive events or share characteristics indicating greater information asymmetry. Confidential holdings exhibit superior performance up to 12 months, and tend to take longer to build. Together the evidence supports private information and the associated price impact as the dominant motives for confidentiality. http://onlinelibrary.wiley.com/doi/10.1111/jofi.12012/pdf

Ok, so someone had the neat idea of running a regression of hedge fund performance against the percentage of portfolios that they disclose through amendments. Woohoo! Journal of Finance! Oh, wow, it was probably mostly done by a grad student too (Yuehua Tang).

As for the strategies, of course you have to take bids and asks. These are reported in nearly every market database. You also have to be conservative in estimating market impact for larger strategies- the fact is that you may not be able to execute some strategy with millions of dollars off of a bid or ask of 500 shares, but there are a number of models commercially available for empirically guessing how much such a transaction would move the market.

If you (1) have a valid arbitrage strategy that WILL make money and (2) use it to make a convincing argument about financial theory, you pretty much have a publication in either the Big Three or one of the next few journals.

Of course, sometimes the best strategies and ideas never get published.

1.) Come up with a theory about the markets. Ideally one that relies on data that wasn't available 20 years ago. (This may rule out theories on cash equities) 2.) Design a strategy to test that theory. 3.) Figure out whether the results show anything. Ideally, try to have a natural experiment with a control and a test. 4.) Figure out how interesting and meaningful those results are. 5.) Clean it up and try to publish it.

You should be able to cycle through 1-4 in 40 hours of work. 5 will take another ~80 hours before you submit to your first journal. Also it's wise to submit to some repository so your idea doesn't get scooped.

I just noticed you also asked about the UK in your first post. So I'll mention that briefly as well.

Basically, in the UK, LBS is basically an American school and is the only UK school that ranks really well globally. LSE has a good name in industry but they're very large and not that respected internationally in "academic finance" or accounting, and apparently treat their PhD students quite poorly. LSE , Warwick, Imperial, Cass, Oxford and Cambridge are pretty much what you would treat as the second tier of schools in the UK after LBS with each having some sort of problem: Cambridge's faculty of finance is tiny and very junior but decent, at the other end of the spectrum you have LSE and Cass which are really big but with a lot of mediocre people and bought talent. Oxford had like 3 people go to this year's AFA meeting which was quite impressive for a faculty as small as theirs. For the UK and finance, LBS is the way to go and should that fail, then LSE and Oxford. But there are many many schools that are as good as LSE and Oxford which are not impossible to get into in the US so at that point it becomes a point of how much funding you can get and how well the research interests match yours. For accounting, I have no idea really because it seems like accounting research in Europe and accounting in the US are done completely differently and European researchers are just unable to get good publications into the top US journals but dominate publishing in AOS. I don't know enough to rank the schools but LBS's department of accounting seems fairly good by international standards (faculty seem to publish in the top US journals), even though it's quite small.

As for if you have a valid arbitrage strategy, lots of people think they do and try to publish them but get rejected. Why? Because most likely they're ignoring something... A lot of professionals think they've got a winning strategy but if they exposed that strategy to the kind of scrutiny that academic ideas get they'd realize just how flawed it actually is.

There have been a couple of arbitrages published in recent years but in reality they're quite rare.. If you have a valid arbitrage strategy that will make money, chances are that either you can use it to make a lot of money (doesn't happen often in practice) or you can publish it (doesn't happen often either).

This isn't that complicated, though.

Anyhow, OP, I strongly recommend http://www.urch.com/forums/phd-business/ instead of here. Here you just have too few people who know anything about the process and too many people who will answer without knowing anything for this forum to be useful (not referring to anyone on this thread but this whole forum)

PhD in Finance vs. Working ( Originally Posted: 10/28/2012 )

I'm early into a PhD program in Finance at a 10-20 ranked b-school. I'm not so sure about going the academia route if I do complete my degree, and find myself more excited about building a career as a researcher in the AM industry. Considering the options of (1) finishing the PhD and going into AM as a researcher, or (2) trying to find a buy or sell side research job and quitting the program (I already have a Master's), does anyone out there with experience have any advice or comparisons for these two paths? Is the ceiling higher with the PhD, and is it worth the 5 year investment?

Geez, finance PhD programs are insanely competitive. If you're in a good program, I would stay where you are.

Depending on your location, you should be able to find part-time work/ internships / consulting jobs while you are working on your degree. If you come out with strong work experience and a good thesis, just about any buyside firm will at least give you a look.

I assume you have a stipend? Then the only cost is opportunity. In this market, staying in a PhD program isn't a terrible idea. You could always quit if you get an offer from a top fund - but in the meantime, you are building your resume (and hopefully getting work experience).

I do have a stipend, but unfortunately my program won't allow me to take outside work while enrolled in the program. So my options for building work experience are pretty limited.

A phD will definitely get you noticed but if you don't have any relevant experience, summer internship , etc, then you will be just like every other PhD who is having a career crises. The problem with a masters at a non-feeder school is that there are many people with them (MFE, etc.) so your resume won't stand out too much. I would say the ceiling is not higher with a PhD but it will help you get noticed by top shops/ AM firms.

If you don't want to do quant/systematic strategies then the value proposition of a PhD diminishes. But again, a PhD will get you noticed in any shop that isn't straight fundamental.

I would think that if you're at a top school then many of your professors consult for the industry. you should ask them about their experience and then also see if they can help you get a summer internship or help them on a project. that should give you a better idea if you think it's worth quitting your program.

Since you're pursuing a PhD in Finance, you're most likely going to be offered positions in quantitative finance research(derivatives pricing). It isn't that bad of a place to be. If you don't want to complete your thesis, then by all means start applying to all the major companies.

You're most likely in a small predicament. I'm guessing you don't know how to program the common languages used like c, c++, java, and python which would rule you out of many quantitative research positions. Given that, you'll be in a more competitive pool competing with students straight out of undergrad for research positions. Since you have a masters, many company HR reps will say you deserve higher pay. But then you've got to think about the department budget and who's running it and what they're willing to sacrifice. In a sense, you run the risk of being overqualified for a research position but under-qualified for another(quant finance research).

With that said, i'd recommend you get through the remainder years and complete your phd.

If you really want to go into industry, 2 years of programming will do you well, C++, Java, and Python at the minimum.

I would have to disagree with one of the above posters. Do not tell your professors that you're planning to go into industry. As you already know, the whole point of a PhD is to prepare you to be an academic researcher. You'll most likely face some opposition when planning your thesis if you tell your professors that your headed to industry.

These are some links which should be of help if you're looking for an industry career post PhD

http://www.econjobrumors.com/topic/phd-in-finance-for-private-sector http://www.econjobrumors.com/topic/afa-private-sector-aqr-blackrock http://www.econjobrumors.com/topic/us-industry-salaries-for-phds/page/1 http://www.econjobrumors.com/topic/most-economists-are-losers

http://www.econjobrumors.com/topic/accounting-phd-vs-finance-phd

afajof.org/association/jobs.asp

Also, finish the PhD. Somehow. The signal premium is worth it. You could arguably drop out with an MS which was paid for and go to work on the street as a quant, but Dr. ABC > Mr. ABC.

Also the buy side roles which are available to Finance PhDs are VERY different from the roles held by MFEs.

Incremental benefit for doing Phd finance ( Originally Posted: 04/13/2013 )

Seeing recently stats of leading business school in US and UK (especially), i was amazed to find that msc/ms programs in finance requirements besides funding are less but they create greater monetary value for finance graduate. On other hand, phd guys invest 5 years with no experience/industry links have to end p on almost same salary. Starting salary for MS guy in year 0 ( just after graduation) is suppose 70 K then it would be approx 92 K by end of differential 4 years ( assuming 7 % increment in annual salary) On other hand, how many phd guys cross on such break even of 92 K at start?

I don't think that money is what is driving people to Finance PhDs. At least not as much as MS . But there are probably other things involved as well.

meaning you agree that on monetary ( or more precisely quantitative return on investment ) terms, phd is behind.

i actually put these facts to this forum just after seeing very few "quality" Masters level specialized fin. programs in US, on other hand all big universities are investing through doctorate level finance courses in finance industry.

From my understanding most of the PHD students in business schools go there for free. Most of these people want to teach and do research, which is cool. I don't think most of them get a phd for the money, it is more like credential that they need to be able to teach and do research.

PhD finance for a job in market ( Originally Posted: 07/17/2015 )

I am starting a PhD program in finance this September. My ultimate aim is to be a researcher in the AM industry and maybe in hedge funds. You might think that PhD is a painful and not a certain path to achieve it, but I would also like to keep options open for academia for the future.

My question here would be the areas/topics that industry might find attractive and that I can excel during my PhD. I am interested in topics in asset pricing and behavioral finance, like analysing/creating models to see the difference in prices of financial products in different stages of business cycles, etc. I am not sure whether those are relevant topics for AM and hedge fund analysts?

WRT my background, I do have a BS in Physics and MS in Finance so I feel I have capacities in both quantitative and financial areas. I am quite good in MATLAB, but VBA and C++ or Java seem a-must to be in the market.

Please let me know which topics I need to focus on my PhD study, the ones that significantly help me to land some jobs in relevant areas. Not sure whether it make any sense, but my studies were in Europe and i want to stay in Europe. The school is ranked in the European top 10-20 with a few excellent researchers.

Many thanks

If you're getting a PhD and know matlab I would assume you can pick up vba in a few minutes, it's pretty basic (no pun intended)

Check out quantnet and poets and quants

I don't have any input here other than that I'd be careful about listening to advice from here for something as sensitive as your PHD thesis. I would reach out directly to HF 's directly and anyone else you want to work with else well.

Finance PhD's ( Originally Posted: 06/28/2007 )

What's the typical starting job for fresh Finance PhD's other than academia? Do they tend to go into quant-based funds or something similar or do a lot start out at Associated at BB 's?

Also, does it matter which school you get your PhD from? Can a PhD from Tier 2 B-school get a good job or is he/she going to have a hard time?

Why are you asking? These types of questions alone are a pretty good indication that you will never be a Finance PhD.

But to answer your question Finance PhDs have been known to secure jobs as quants and associates at BBs . Like always the better the school...the better your chances of landing these types of jobs.

Personally, I think a PhD in Finance is a complete waste of time unless you had your heart sent on the academic world. If youre brainy enough to get a PhD in finance youre probably brainy enough to get a PhD or at least a Masters in Math/Stats/CompSci/Physics, all of which are probably more marketable in the academic world AND finance.

I concur with Schumacher.

I was talking a bit ago with an MD at a MM I-bank and someone asked him a similar question. He responded with, while anything is possible, attaining a PhD in Finance won't really help your chances to get into Ibanking all that much. He personally felt that people who go this route tend to get too used to the culture and routine that is involved with school, and are better equipped to become a professor than to attempt to enter the business world.

One of the top interest rate quants in the world is a finance PhD.

Math Finance PhD to Wall Street ( Originally Posted: 10/17/2015 )

Long time reader, first time poster...

I'm currently a student in one of the top math finance programs. Until recently I'd planned on joining a finance department at a business school after completing my PhD. Unfortunately, having taken a number of finance courses not offered by the math department - we offer few topics courses - and I've discovered that most of the finance research is mathematically and/or statistically unsound.* The math finance research while rigorous is utterly useless.** As such, I'm strongly considering a transition back to the private sector.

Prior to joining my PhD, I worked in data analytics consulting for four years. I've generally held sales roles and have been client facing. I'm not your typical PhD: I love client interations, I wasn't a nerd in college or HS though I went to a good university, and I was an athlete throughout college and HS. Ideally, I'd like a role that facilitates a lot of social interaction and that's close to the money. Seeing the jobs most of our people get, and yes it's mainly quant jobs in banks or hedge funds , I've acquired the impression that those two things don't characterize their everyday tasks. Should I complete my PhD? Is there a role for a PhD that doesn't make you a trader's bitch or turn you into some sort of quasi-academic troll at Two Sigma?

I'm interested in why you think quants are quasi-academic trolls?

I've heard a lot of quants say that having a postgraduate math degree for quant roles is completely unnecessary/overkill, since the math you learn as an undergraduate math major is sufficient. It's more a function of marketability, or advertising on behalf of the firms who hire these math PhDs.

Also, your comments on mathematical-finance research seems reasonable given many of the opinions of renown quants. Apparently, a lot of the research has just become completely useless and unsound - essentially mental masturbation.

Keep in mind, quants at places like AQR/Two Sigma do more than just research - they also develop and execute actual investment strategies.

The issue is that your background already puts you into the 'quantitative roles bucket'. It may be difficult to convince people in roles with more client-interaction that they should hire you. Trading, risk and investment management roles are what's open to you right now. Of these, investment management would probably offer the most client-interactions.

Investment management at a BB like Goldman Sachs Asset Management , as opposed to a quant fund, may offer a bit more of what you're looking for. I have seen some quants (with/without PhDs) in asset management roles at BB banks. I also hear that Asset Management has quite a bit of client interaction, although others are better qualified to advise you on this.

If you want to get out of quant roles completely, then you're going to have more trouble. This is made significantly worse by the fact that you're a Math PhD, rather than straight out of undergrad. It makes you an 'experienced' hire and I'm not sure how well a Math PhD would be able to recruit for an IB analyst role, ect.

Careers options for PhD in Finance (Other than academia) ( Originally Posted: 11/14/2015 )

I am a first year PhD Finance student at a school which has very a solid reputation in overall but not the top in finance. As a PhD student, my priority is on getting an academic position, but I am also interested in career options in the industry.

Are there substantial number of people getting into IBD or Sales & Trading with a finance phd degree? I am also considering to quant or strats positions, but computational language is not something that I am familiar with.

I know that investment banks prefer fresh college graduates or MBA students over PhD candidates for their front office tasks other than quant, but I also heard that some trading desks dealing with more complicated products such as structure rates or exotics willingly hire PhD guys. Is that true?

If my research is on corporate finance , more specifically capital structure of firms, would it boost my employability for IBD ?

In terms of locational preference, I would not mind to work in any of major financial centers around world. (NY, London or HK) So, if you have any knowledge on those places, please give me some insight.

Quant Hedge Funds. Although it totally depends on the penchant of your PHD program. Quantitative Researchers are research (new models) and programming focused.

IBD I would say a no. You're likely too old and a bit too quantitatively orientated for the role which is as much soft skills as hard science. I would imagine you may have an easier time on the S&T side with a quant desk but I would think you'd likely need to develop some coding skills which frankly shouldn't be that hard to pick up.

Thanks, guys. So you guys suggest that only 'quant' related positions would be available for me? And for the programming language, I am currently using matlab and R for my coursework and research. Would it be sufficent?

undefined: Thanks, guys. So you guys suggest that only 'quant' related positions would be available for me? And for the programming language, I am currently using matlab and R for my coursework and research. Would it be sufficent?

Matlab and R are perfect. In trading , you want a language you can crunch data / backtest strategies with (R / Python) as well as one that has solid execution when you go live (Matlab / Python / C++). Look into statistical arbitrage / pairs trading, you should pick this up no problem w/ your background. Download a few data sets online, run some simple analysis to start, and you can formulate a strategy to start paper trading on your own. From there you can join prop desks, HFT , structuring etc.

If algorithmic trading doesn 't interest you and you don't want to go the pure academic route another way in is through a multilateral organization as an economist . After a few years those positions can set you up well to jump to a bank or hedge fund where you can make some serious coin.

I like the idea about economics. There is a third option other than industry and academia... Government!

Federal Reserve has nice paychecks and exit opps... They cap out around 200 k though if I remember right.

And PLEASE... If you want to go to industry do NOT do research on corporate finance . I would use the opportunity to find an arbitrage or something other statistically significant relationship which produces consistent alpha .

econ/finance phd ( Originally Posted: 04/08/2007 )

if you are currently in a econ or finance phd program what exit opportunities are there on wall street

FI and Equity Quant Reserch/Deriv Pricing groups, banks like Lehman and CS have a PhD day/presentation some time in fall, where they tell about PhD opportunities. make sure you school work is quant/econometrics related. Are you Stern fin or econ ?

just looking @ my options

You can become a professor.

Finance Phd ( Originally Posted: 10/23/2011 )

I am doing Phd in finance, passed the first two levels of CFA exams. I have been told that my background fits for buy side firms, especially HFs . My uni is not an ivy league school though. What do you think is the best way for me to contact HFs?

As my uni is not an ivy league school, they are not coming to my uni and it is hard for me to find something through the alumni.

Thanks in advance.

Cold call/ cold email tons of firms. Use Linkedin to connect with people at HFs you would be interested in working for. I'd imagine it wouldn't be hard to get responses since you're doing a PhD.

What topics are you studying in finance.. I'm just being nosy as I didn't know they offered such a Ph.d

My thesis in on market microstructure of derivatives market. I also work on asset pricing.

Let's say I am graduating in summer, when do you think I should start sending e-mails?

3 years ago.

buybuybuy: 3 years ago.

Agreed. Start emailing and calling ASAP. Attend as many networking events as possible. Tap into the alumni networks of both your PhD school and BA/ BS school, as well as any possible masters you may have done.

New here & im a PHD Finance hunter ( Originally Posted: 04/11/2014 )

Trying to get ideas about PHD finanace proposal.

Not sure if trolling, but if you're seriously looking for someone else to come up with your Phd topic, you probably should not be pursuing a Phd in the first place.

You should probably be talking with your advisor.

This cant be serious :)

finance phd ( Originally Posted: 10/01/2011 )

I will graduate this summer and I am taking CFA level 3 exam this June.I am good at econometrics , R and Matlab. My uni is not an ivy league school, but has a good reputation.

Sell side quants told me that my profile suits better for buy side jobs. I am wondering which buy side firms hire finance phds. Thanks in advance.

Take a look around the Hedge Fund forum. This site has alot of great resources. Here's some for you:

WSO hedge fund career guide

Phd in Finance profile eval ( Originally Posted: 09/27/2014 )

Hi Gurus out there.

I am interested in applying to Finance Phd program.

I would like gurus here to provide me some insights/ideas on my chances getting into these programs listed below:

Uni. of Michigan, UCLA, Duke, USC, Cornell, Boston College, University of Florida, Rutgers.

To provide info on my background/stats:

UGPA: 3.45 & GPGA: 3.5. Studied EE during undergrad and Comp. Engr as major and econ as minor studies during grad school w/ full fellowship & stipend.

GRE V 156 GRE Q 170 AWA 4... I know i bombed my verbal :(

1.5 yrs of research experience & winning IEEE research fellowship/scholarship for my research.

2 yrs of working @ High tech firm (think apple or google) by the time i enroll to phd program..

I am particularly worried about my gpa since it is not 3.8 or 3.9 as advertised on many phd program website...

Do you gurus think if I have a reasonable chance to get into one of the programs I listed above? And is there any particular area I should improve or work on, say GRE verbal for example?

Any advice or comment will be appreciated :)

Just to add another piece of info...

i received my BSE & MSE from top 5 engineering program.....

Your background certainly isn't bad. I have done some reading in finance PhD programs and I think you have a lot of points in your favor. I think it is likely that you will be able to get in somewhere, however there are a few things to keep I mind from what I've read:

The Math. Have you taken Real Analysis in undergrad? Finance and Econ PhDs are pretty brutal math-wise and knowing the EE students I know, it is very possible to come out of an engineering program without a strong enough math background for a Finance/Econ PhD.

You alluded to this in your post but finance PhD programs are extremely competitive. Even for someone like you it will be tough to get in to a top program.

Research fellowship is a big point in your favor, leverage that in your application.

Great thanks for your comment. First of all, here is a list of math courses I took: Cal I, II, III, IV, Linear Algebra, statistics, Regression/forecasting, Probabilistic method in engineering which covers some Real Analysis, and many other engineering courses requiring intro knowledge level of Real analysis. But I have not taken a course called Real Analysis. And I am aware of the competitiveness of the Finance PHD program :(

What do you think of my lowish gpa and verbal score? Any reg flag or yellow card?

Finance PhD ( Originally Posted: 08/11/2011 )

Most recent post on this seems to be in 2007.

To put it simply, I did my undergrad in Finance, have an MBA , and am taking CFA Level III next June. Working in ER currently.

Really considering going and doing my doctorate. Love the researching professor lifestyle and autonomy. Anyone done this? Advice going forward? (Starting next fall)

That actually sound pretty cool...

I'm actually interested in pursuing this path as well

Professor Jarrow at Cornell was a math major and a MBA from Tuck. He got his PhD at MIT in 3 years after that. Look up HJM model.

To the OP, what specific field within finance are you interested in?

I dropped out of an Econ PhD, so if anyone is considering this path and wants to ask me any questions, feel free to PM me.

The life of an academic is, to misquote Thomas Hobbes, "solitary, poor, nasty, brutish" and shit.

You have much less autonomy you think you do; you're obliged to churn out a constant streams of papers that will (most likely) be read by almost nobody; and, you have to be prepared to relocate to the middle-of-nowhere's-ville to take a job teaching undergrads. To make things worse, the actual process of researching can be incredibly lonely too.

Not for me. And I strongly considered it.

Specific field of interest would be more on the corporate side of things -- M&A, spin-offs, restructurings, etc.

Thanks for the input, all. Definitely is a major decision with ramifications, but there's a major part of me that believes I will regret it if I don't do it.

Also, I think that a major catalyst for my thought process here is that I don't really see myself living tick-by-tick to the stock market, or being so focused on a given industry that I can tell you the exact inventory level for a company 3 quarters ago. Don't get me wrong, I love my job right now -- and I think that analysts who are so in tune with an industry are really good, and it's amazing to see that level of knowledge about companies.

I feel like the things that I like about doing ER I can do for my own portfolio on a go-forward basis. And I also want to make sure that I can have solid balance in my life -- be a husband, be a good dad. Not that it can't be done in ER , but the balance challenge is significantly more difficult.

I'm aware that academia is no bed of roses and that there's no "free lunch", but I feel like, for me, the benefits outweigh the costs.

Fair enough.

Do a Masters and re-assess. I was dead set on avoiding the City and "corporate" economics when I finished my undergrad. Two years later I u-turned.

So long as you apply yourself with gusto- and don't look back- you can't really go wrong, as with most things in life. Until your set off in the direction, keep your options open and don't burn any bridges.

PhD Finance for I-Banks !? ( Originally Posted: 11/10/2007 )

i'm currently studying economics and am considering a phd in finance, I'm still having about 2years ahead until graduation though.

Why I would like yet to get a clear opinion whether or not to pursue a PhD afterwards is, since if I wanted to do one (in a really good school) I would need to concentrate more (maybe entirely) on my studies now in order to get a sufficient good degree, in contrast to doing as many as possible relevant internships in order to get a good job directly after graduation. Aside from that I would need to apply already in about a year I guess.