- Search Search Please fill out this field.

- Assets & Markets

- Mutual Funds

Efficient Markets Hypothesis (EMH)

EMH Definition and Forms

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-03-23at2.04.43PM-59de96b153e540c498f1f1da8ce5c965.png)

What Is Efficient Market Hypothesis?

What are the types of emh, emh and investing strategies, the bottom line, frequently asked questions (faqs).

The Efficient Market Hypothesis (EMH) is one of the main reasons some investors may choose a passive investing strategy. It helps to explain the valid rationale of buying these passive mutual funds and exchange-traded funds (ETFs).

The Efficient Market Hypothesis (EMH) essentially says that all known information about investment securities, such as stocks, is already factored into the prices of those securities. If that is true, no amount of analysis can give you an edge over "the market."

EMH does not require that investors be rational; it says that individual investors will act randomly. But as a whole, the market is always "right." In simple terms, "efficient" implies "normal."

For example, an unusual reaction to unusual information is normal. If a crowd suddenly starts running in one direction, it's normal for you to run that way as well, even if there isn't a rational reason for doing so.

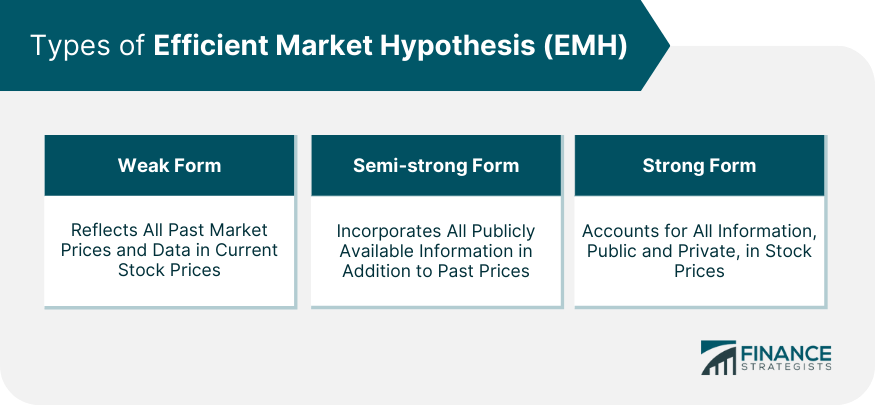

There are three forms of EMH: weak, semi-strong, and strong. Here's what each says about the market.

- Weak Form EMH: Weak form EMH suggests that all past information is priced into securities. Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. But no "patterns" exist. Therefore, fundamental analysis does not provide a long-term advantage, and technical analysis will not work.

- Semi-Strong Form EMH: Semi-strong form EMH implies that neither fundamental analysis nor technical analysis can provide you with an advantage. It also suggests that new information is instantly priced into securities.

- Strong Form EMH: Strong form EMH says that all information, both public and private, is priced into stocks; therefore, no investor can gain advantage over the market as a whole. Strong form EMH does not say it's impossible to get an abnormally high return. That's because there are always outliers included in the averages.

EMH does not say that you can never outperform the market . It says that there are outliers who can beat the market averages. But there are also outliers who lose big to the market. The majority is closer to the median. Those who "win" are lucky; those who "lose" are unlucky.

Proponents of EMH, even in its weak form, often invest in index funds or certain ETFs. That is because those funds are passively managed and simply attempt to match, not beat, overall market returns.

Index investors might say they are going along with this common saying: "If you can't beat 'em, join 'em." Instead of trying to beat the market, they will buy an index fund that invests in the same securities as the benchmark index.

Some investors will still try to beat the market, believing that the movement of stock prices can be predicted, at least to some degree. For that reason, EMH does not align with a day trading strategy. Traders study short-term trends and patterns. Then, they attempt to figure out when to buy and sell based on these patterns. Day traders would reject the strong form of EMH.

For more on EMH, including arguments against it, check out the EMH paper from economist Burton G. Malkiel. Malkiel is also the author of the investing book "A Random Walk Down Main Street." The random walk theory says that movements in stock prices are random.

If you believe that you can't predict the stock market, you would most often support the EMH. But a short-term trader might reject the ideas put forth by EMH, because they believe that they are able to predict changes in stock prices.

For most investors, a passive, buy-and-hold , long-term strategy is useful. Capital markets are mostly unpredictable with random up and down movements in price.

When did the Efficient Market Hypothesis first emerge?

At the core of EMH is the theory that, in general, even professional traders are unable to beat the market in the long term with fundamental or technical analysis . That idea has roots in the 19th century and the "random walk" stock theory. EMH as a specific title is sometimes attributed to Eugene Fama's 1970 paper "Efficient Capital Markets: A Review of Theory and Empirical Work."

How is the Efficient Market Hypothesis used in the real world?

Investors who utilize EMH in their real-world portfolios are likely to make fewer decisions than investors who use fundamental or technical analysis. They are more likely to simply invest in broad market products, such as S&P 500 and total market funds.

Corporate Finance Institute. " Efficient Markets Hypothesis ."

IG.com. " Random Walk Theory Definition ."

What is Efficient Market Hypothesis? | EMH Theory Explained

The efficient market hypothesis (EMH) can help explain why many investors opt for passive investing strategies, such as buying index funds or exchange-traded funds ( ETFs ), which generate consistent returns over an extended period. However, the EMH theory remains controversial and has found as many opponents as proponents. This guide will explain the efficient market hypothesis, how it works, and why it is so contradictory.

Best Crypto Exchange for Intermediate Traders and Investors

Invest in 70+ cryptocurrencies and 3,000+ other assets including stocks and precious metals.

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

Copy top-performing traders in real time, automatically.

eToro USA is registered with FINRA for securities trading.

What is the efficient market hypothesis?

The efficient market hypothesis (EMH) claims that all assets are always fairly and accurately priced and trade at their fair market value on exchanges. If this theory is true, nothing can give you an edge to outperform the market using different investing strategies and make excess profits compared to those who follow market indexes.

Efficient market definition

An efficient market is where all asset prices listed on exchanges fully reflect their true and only value, thus making it impossible for investors to “beat the market” and profit from price discrepancies between the market price and the stock’s intrinsic value. The EMH claims the stock’s fair value, also called intrinsic value , is much the same as its market value , and finding undervalued or overvalued assets is non-viable.

Intrinsic value refers to an asset’s true, actual value, which is calculated using fundamental and technical analysis, whereas the market price is the currently listed price at which stock is bought and sold. When markets are efficient, the two values should be the same, but when they differ, it poses opportunities for investors to make an excess profit.

For markets to be completely efficient, all information should already be accounted for in stock prices and are trading on exchanges at their fair market value, which is practically impossible.

Hypothesis definition

A hypothesis is merely an assumption, an idea, or an argument that can be tested and reasoned not to be true. Something that isn’t fully supported by full facts or doesn’t match applied research.

For example, if sugar causes cavities, people who eat a lot of sweets are prone to cavities. And if the same applies here – if all information is reflected in a stock’s price, then its fair value should be the same as its market value and can not differ or be impacted by any other factors.

Beginners’ corner:

- What is Investing? Putting Money to Work ;

- 17 Common Investing Mistakes to Avoid ;

- 15 Top-Rated Investment Books of All Time ;

- How to Buy Stocks? Complete Beginner’s Guide ;

- 10 Best Stock Trading Books for Beginners ;

- 15 Highest-Rated Crypto Books for Beginners ;

- 6 Basic Rules of Investing ;

- Dividend Investing for Beginners ;

- Top 6 Real Estate Investing Books for Beginners ;

- 5 Passive Income Investment Ideas .

Fundamental and technical analysis in an efficient market

According to the EMH, stock prices are already accurately priced and consider all possible information. If markets are fully efficient, then no fundamental or technical analysis can help investors find anomalies and make an extra profit.

Fundamental analysis is a method to calculate a stock’s fair or intrinsic value by looking beyond the current market price by examining additional external factors like financial statements, the overall state of the economy, and competition, which can help define whether the stock is undervalued.

Also relevant is technical analysis , a method of forecasting the value of stocks by analyzing the historical price data, mainly looking at price and volume fluctuations occurring daily, weekly, or any other constant period, usually displayed on a chart.

The efficient market theory directly contradicts the possibility of outperforming the market using these two strategies; however, there are three different versions of EMH, and each slightly differs from the other.

Three forms of market efficiency

The efficient market hypothesis can take three different forms , depending on how efficient the markets are and which information is considered in theory:

1. Strong form efficiency

Strong form efficiency is the EMH’s purest form, and it is an assumption that all current and historical, both public and private, information that could affect the asset’s price is already considered in a stock’s price and reflects its actual value. According to this theory, stock prices listed on exchanges are entirely accurate.

Investors who support this theory trust that even inside information can’t give a trader an advantage, meaning that no matter how much extra information they have access to or how much analysis and research they do, they can not exceed standard returns.

Burton G. Malkiel, a leading proponent of the strong-form market efficiency hypothesis, doesn’t believe any analysis can help identify price discrepancies. Instead, he firmly believes in buy-and-hold investing, trusting it is the best way to maximize profits. However, factual research doesn’t support the possibility of a strong form of efficiency in any market.

2. Semi-strong form efficiency

The semi-strong version of the EMH suggests that only current and historical public (and not private) information is considered in the stock’s listed share prices. It is the most appropriate form of the efficient market hypothesis, and factual evidence supports that most capital markets in developed countries are generally semi-strong efficient.

This form of efficiency relies on the fact that public news about a particular stock or security has an immediate effect on the stock prices in the market and also suggests that technical and fundamental analysis can’t be used to make excess profits.

A semi-strong form of market efficiency theory accepts that investors can gain an advantage in trading only when they have access to any unknown private information unknown to the rest of the market.

3. Weak form efficiency

Weak market efficiency, also called a random walk theory, implies that investors can’t predict prices by analyzing past events, they are entirely random, and technical analysis cannot be used to beat the market.

Random walk theory proclaims stock prices always take a randomized path and are unpredictable, that investors can’t use past price changes and historical data trends to predict future prices, and that stock prices already reflect all current information.

For example, advocates of this form see no or limited benefit to technical analysis to discover investment opportunities. Instead, they would maintain a passive investment portfolio by buying index funds that track the overall market performance.

For example, the momentum investing method analyzes past price movements of stocks to predict future prices – it goes directly against the weak form efficiency, where all the current and past information is already reflected in their market prices.

A brief history of the efficient market hypothesis

The concept of the efficient market hypothesis is based on a Ph.D. dissertation by Eugene Fama , an American economist, and it assumes all prices of stocks or other financial instruments in the market are entirely accurate.

In 1970, Fama published this theory in “Efficient Capital Markets: A Review of Theory and Empirical Work,” which outlines his vision where he describes the efficient market as: “A market in which prices always “fully reflect” available information is called “efficient.”

Another theory based on the EMH, the random walk theory by Burton G. Malkiel , states that prices are completely random and not dependent on any factor. Not even past information, and that outperforming the market is a matter of chance and luck and not a point of skill.

Fama has acknowledged that the term can be misleading and that markets can’t be efficient 100% of the time, as there is no accurate way of measuring it. The EMH accepts that random and unexpected events can affect prices but claims they will always be leveled out and revert to their fair market value.

What is an inefficient market?

The efficient market hypothesis is a theory, and in reality, most markets always display some inefficiencies to a certain extent. It means that market prices don’t always reflect their true value and sometimes fail to incorporate all available information to be priced accurately.

In extreme cases, an inefficient market may even lead to a market failure and can occur for several reasons.

An inefficient market can happen due to:

- A lack of buyers and sellers;

- Absence of information;

- Delayed price reaction to the news;

- Transaction costs;

- Human emotion;

- Market psychology.

The EMH claims that in an efficiently operating market, all asset prices are always correct and consider all information; however, in an inefficient market, all available information isn’t reflected in the price, making bargain opportunities possible.

Moreover, the fact that there are inefficient markets in the world directly contradicts the efficient market theory, proving that some assets can be overvalued or undervalued, creating investment opportunities for excess gains.

Validity of the efficient market hypothesis

With several arguments and real-life proof that assets can become under- or overvalued, the efficient market hypothesis has some inconsistencies, and its validity has repeatedly been questioned.

While supporters argue that searching for undervalued stock opportunities using technical and fundamental analysis to predict trends is pointless, opponents have proven otherwise. Although academics have proof supporting the EMH, there’s also evidence that overturns it.

The EMH implies there are no chances for investors to beat the market, but for example, investing strategies like arbitrage trading or value investing rely on minor discrepancies between the listed prices and the actual value of the assets.

A prime example is Warren Buffet, one of the world’s wealthiest and most successful investors, who has consistently beaten the market over more extended periods through value investing approach, which by definition of EMH is unfeasible.

Another example is the stock market crash in 1987, when the Dow Jones Industrial Average (DJIA) fell over 20% on the same day, which shows that asset prices can significantly deviate from their values.

Moreover, the fact that active traders and active investing techniques exist also displays some evidence of inconsistencies and that a completely efficient market is, in reality, impossible.

Contrasting beliefs about the efficient market hypothesis

Although the EMH has been largely accepted as the cornerstone of modern financial theory, it is also controversial. The proponents of the EMH argue that those who outperform the market and generate an excess profit have managed to do so purely out of luck, that there is no skill involved, and that stocks can still, without a real cause or reason, outperform, whereas others underperform.

Moreover, it is necessary to consider that even new information takes time to take effect in prices, and in actual efficiency, prices should adjust immediately. If the EMH allows for these inefficiencies, it is a question of whether an absolute market efficiency, strong form efficiency, is at all possible. But as this theory implies, there is little room for beating the market, and believers can rely on returns from a passive index investing strategy.

Even though possible, proponents assume neither technical nor fundamental analysis can help predict trends and produce excess profits consistently, and theoretically, only inside information could result in outsized returns.

Moreover, several anomalies contradict the market efficiency, including the January anomaly, size anomaly, and winners-losers anomaly, but as usual, factual evidence both contradicts and supports these anomalies.

Parting opinions about the different versions of the EMH reflect in investors’ investing strategies. For example, supporters of the strong form efficiency might opt for passive investing strategies like buying index funds. In contrast, practitioners of the weak form of efficiency might leverage arbitrage trading to generate profits.

Marketing strategies in an efficient and inefficient market

On the one side, some academics and investors support Fama’s theory and most likely opt for passive investing strategies. On the other, some investors believe assets can become undervalued and try to use skill and analysis to outperform the market via active trading.

Passive investing

Passive investing is a buy-and-hold strategy where investors seek to generate stable gains over a more extended period as fewer complexities are involved, such as less time and tax spent compared to an actively managed portfolio.

People who believe in the efficient market hypothesis use passive investing techniques to create lower yet stable gains and use strategies with optimal gains through maximizing returns and minimizing risk.

Proponents of the EMH would use passive investing, for example:

- Invest in Index Funds;

- Invest in Exchange-traded Funds (ETFs).

However, it is important to note that other mutual funds also use active portfolio management intending to outperform indices, and passive investing strategies aren’t only for those who believe in the EMH.

Active investing

Active portfolio managers use research, analysis, skill, and experience to discover market inefficiencies to generate a higher profit over a shorter period and exceed the benchmark returns.

Generally, passive investing strategies generate returns in the long run, whereas active investing can generate higher returns in the short term.

Opponents of the EMH might use active investing techniques, for example:

- Arbitrage and speculation;

- Momentum investing ;

- Value investing .

The fact that these active trading strategies exist and have proven to generate above-market returns shows that prices don’t always reflect their market value.

For instance, if a technology company launches a new innovative product, it might not be immediately reflected in its stock price and have a delayed reaction in the market.

Suppose a trader has access to unpublished and private inside information. In that case, it will allow them to purchase stocks at a much lower value and sell for a profit after the announcement goes public, capitalizing on the speculated price movements.

Passive and active portfolio managers are often compared in terms of performance, e.g., investment returns, and research hasn’t fully concluded which one outperforms the other,

Efficient market examples

Investors and academics have divided opinions about the efficient market hypothesis, and there have been cases where this theory has been overturned and proven inaccurate, especially with strong form efficiency. However, proof from the real world has shown how financial information directly affects the prices of assets and securities, making the market more efficient.

For example, when the Sarbanes-Oxley Act in the United States, which required more financial transparency through quarterly reporting from publicly traded businesses, came into effect in 2002, it affected stock price volatility. Every time a company released its quarterly numbers, stock market prices were deemed more credible, reliable, and accurate, making markets more efficient.

Example of a semi-strong form efficient market hypothesis

Let’s assume that ‘stock X’ is trading at $40 per share and is about to release its quarterly financial results. In addition, there was some unofficial and unconfirmed information that the company has achieved impressive growth, which increased the stock price to $50 per share.

After the release of the actual results, the stock price decreased to $30 per share instead. So whereas the general talk before the official announcement made the stock price jump, the official news launch dropped it.

Only investors who had inside private information would have known to short-sell the stock , and the ones who followed the publicly available information would have bought it at a high price and incurred a loss.

What can make markets more efficient?

There are a few ways markets can become more efficient, and even though it is easy to prove the EMH has no solid base, there is some evidence its relevance is growing.

First , markets become more efficient when more people participate, buy and sell and engage, and bring more information to be incorporated into the stock prices. Moreover, as markets become more liquid, it brings arbitrage opportunities; arbitrageurs exploiting these inefficiencies will, in turn, contribute to a more efficient market.

Secondly , given the faster speed and availability of information and its quality, markets can become more efficient, thus reducing above-market return opportunities. A thoroughly efficient market, strong efficiency, is characterized by the complete and instant transmission of information.

To make this possible, there should be:

- Complete absence of human emotion in investing decisions;

- Universal access to high-speed pricing analysis systems;

- Universally accepted system for pricing stocks;

- All investors accept identical returns and losses.

The bottom line

At its core, market efficiency is the ability to incorporate all information in stock prices and provide the most accurate opportunities for investors; however, it isn’t easy to imagine a fully efficient market.

Research has shown that most developed capital markets fall into the semi-strong efficient category. However, whether or not stock markets can be fully efficient conclusively and to what degree continues to be a heated debate among academics and investors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs on the efficient market hypothesis

The efficient market hypothesis (EMH) claims that prices of assets such as stocks are trading at accurate market prices, leaving no opportunities to generate outsized returns. As a result, nothing could give investors an edge to outperform the market, and assets can’t become under- or overvalued.

What are three forms of the efficient market hypothesis?

The efficient market hypothesis takes three forms: first, the purest form is strong form efficiency, which considers current and past information. The second form is semi-strong efficiency, which includes only current and past public, and not private, information. Finally, the third version is weak form efficiency, which claims stock prices always take a randomized path.

What contradicts the efficient market hypothesis?

The efficient market hypothesis directly contradicts the existence of investment strategies, and cases that have proved to generate excess gains are possible, for example, via approaches like value or momentum investing.

When more investors engage in the market by buying and selling, they also bring more information that can be incorporated into the stock prices and make them more accurate. Moreover, the faster movement of information and news nowadays increases accuracy and data quality, thus making markets more efficient.

Weekly Finance Digest

By subscribing you agree with Finbold T&C’s & Privacy Policy

Related guides

10 Biggest AI Companies in the World [2024]

Index Tokens: A Case Study

How to Set Stock Price Alerts | Step-by-Step Guide

What Is the Best Tool for Crypto Price Alerts

11.5 Efficient Markets

Learning outcomes.

By the end of this section, you will be able to:

- Understand what is meant by the term efficient markets .

- Understand the term operational efficiency when referring to markets.

- Understand the term informational efficiency when referring to markets.

- Distinguish between strong, semi-strong, and weak levels of efficiency in markets.

Efficient Markets

For the public, the real concern when buying and selling of stock through the stock market is the question, “How do I know if I’m getting the best available price for my transaction?” We might ask an even broader question: Do these markets provide the best prices and the quickest possible execution of a trade? In other words, we want to know whether markets are efficient. By efficient markets , we mean markets in which costs are minimal and prices are current and fair to all traders. To answer our questions, we will look at two forms of efficiency: operational efficiency and informational efficiency.

Operational Efficiency

Operational efficiency concerns the speed and accuracy of processing a buy or sell order at the best available price. Through the years, the competitive nature of the market has promoted operational efficiency.

In the past, the NYSE (New York Stock Exchange) used a designated-order turnaround computer system known as SuperDOT to manage orders. SuperDOT was designed to match buyers and sellers and execute trades with confirmation to both parties in a matter of seconds, giving both buyers and sellers the best available prices. SuperDOT was replaced by a system known as the Super Display Book (SDBK) in 2009 and subsequently replaced by the Universal Trading Platform in 2012.

NASDAQ used a process referred to as the small-order execution system (SOES) to process orders. The practice for registered dealers had been for SOES to publicly display all limit orders (orders awaiting execution at specified price), the best dealer quotes, and the best customer limit order sizes. The SOES system has now been largely phased out with the emergence of all-electronic trading that increased transaction speed at ever higher trading volumes.

Public access to the best available prices promotes operational efficiency. This speed in matching buyers and sellers at the best available price is strong evidence that the stock markets are operationally efficient.

Informational Efficiency

A second measure of efficiency is informational efficiency, or how quickly a source reflects comprehensive information in the available trading prices. A price is efficient if the market has used all available information to set it, which implies that stocks always trade at their fair value (see Figure 11.12 ). If an investor does not receive the most current information, the prices are “stale”; therefore, they are at a trading disadvantage.

Forms of Market Efficiency

Financial economists have devised three forms of market efficiency from an information perspective: weak form, semi-strong form, and strong form. These three forms constitute the efficient market hypothesis. Believers in these three forms of efficient markets maintain, in varying degrees, that it is pointless to search for undervalued stocks, sell stocks at inflated prices, or predict market trends.

In weak form efficient markets, current prices reflect the stock’s price history and trading volume. It is useless to chart historical stock prices to predict future stock prices such that you can identify mispriced stocks and routinely outperform the market. In other words, technical analysis cannot beat the market. The market itself is the best technical analyst out there.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Authors: Julie Dahlquist, Rainford Knight

- Publisher/website: OpenStax

- Book title: Principles of Finance

- Publication date: Mar 24, 2022

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-finance/pages/11-5-efficient-markets

© Jan 8, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Cost of Capital

- Marginal Cost of Capital

- Required Rate of Return

- Risk Free Rate

- Inflation Premium

- Default Premium

- Liquidity Premium

- Maturity Premium

- Cost of Equity

- Cost of New Equity

- Cost of Preferred Stock

- Flotation Costs

- Cost of Debt

- Sustainable Growth Rate

- Internal Growth Rate

- After-Tax Cost of Debt

- Net Asset Value

- Pure Play Method

- Unlevered Beta

- Strong Form Market Efficiency

- Semi-strong Form Market Efficiency

- Weak Form Market Efficiency

- Theoretical Ex-rights Price

- Yield to Maturity (YTM)

- Current Yield

Strong form of market efficiency is when prices already reflect both publically available information and inside information. In strong form of market efficiency, it is not possible to earn access return by any means.

Strong form of market efficiency is the strongest form of efficient market hypothesis, stronger than the semi-strong form of market efficiency and weak form of market efficiency.

When a market is strong form efficient, neither technical analysis nor fundamental analysis nor inside information can help predict future price movements.

Markets rarely exhibit the characteristics of strong form of market efficiency.

Shintaro Ishihara works at Osaka Automobiles as their chief engineer. He was working on a new advanced model of automobiles and the project was a big success. He was sure that this project will result in an increase in price so he purchased 10,000 shares of Osaka Automobiles for $25 per share. He was surprised to see that even after the news of the project being a success spread, the share price did not increase.

The market seems to be strong form efficient, because it had already adjusted Osaka Automobiles' stock price for the expected net present value of the new project. It already reflected the inside information.

by Obaidullah Jan, ACA, CFA and last modified on Jan 17, 2018

Related Topics

All chapters in finance.

- Time Value of Money

- Capital Budgeting Process

- Capital Structure

- Stock Valuation

- Risk and Return

- Exchange Rates

- Real Estate

- Financial Ratios

- Excel PV Function

- Corporate Finance

- Business Valuation

- Performance Measurement

- Primary & Secondary Market

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

If you still have questions or prefer to get help directly from an agent, please submit a request. We’ll get back to you as soon as possible.

Please fill out the contact form below and we will reply as soon as possible.

- Economics, Finance, & Analytics

- Economic Analysis & Monetary Policy

Strong Form Efficiency (Economics) - Explained

What is Strong-Form Efficiency?

Written by Jason Gordon

Updated at April 23rd, 2024

- Marketing, Advertising, Sales & PR Principles of Marketing Sales Advertising Public Relations SEO, Social Media, Direct Marketing

- Accounting, Taxation, and Reporting Managerial & Financial Accounting & Reporting Business Taxation

- Professionalism & Career Development

- Law, Transactions, & Risk Management Government, Legal System, Administrative Law, & Constitutional Law Legal Disputes - Civil & Criminal Law Agency Law HR, Employment, Labor, & Discrimination Business Entities, Corporate Governance & Ownership Business Transactions, Antitrust, & Securities Law Real Estate, Personal, & Intellectual Property Commercial Law: Contract, Payments, Security Interests, & Bankruptcy Consumer Protection Insurance & Risk Management Immigration Law Environmental Protection Law Inheritance, Estates, and Trusts

- Business Management & Operations Operations, Project, & Supply Chain Management Strategy, Entrepreneurship, & Innovation Business Ethics & Social Responsibility Global Business, International Law & Relations Business Communications & Negotiation Management, Leadership, & Organizational Behavior

- Economics, Finance, & Analytics Economic Analysis & Monetary Policy Research, Quantitative Analysis, & Decision Science Investments, Trading, and Financial Markets Banking, Lending, and Credit Industry Business Finance, Personal Finance, and Valuation Principles

What is Strong Form Efficiency?

Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it private or public. In strong form efficiency, stock prices reflect public and private information about a market. Strong form efficiency is the strongest of the three forms of the efficient market hypothesis. The other forms are the weak and semi-strong forms of market efficiency. According to the proponents of the strong form efficiency, the fact that private of insider information about a market is revealed by the stock price does not give investors an edge in the market.

How does Strong Form Efficiency Work?

There are three forms of market efficiency, the weak form efficiency, semi-strong efficiency and strong form efficiency. The strong form efficiency is one that maintains that securities or stock prices reveal the overall information about a market, whether the information is public or private (insider). The strong form efficiency holds that the overall market is affected by past events of market history and not just random occurrences. In contrast, the weak form efficiency maintains that the overall market is not influenced by past events. That means, current price movements and trends are not affected by past events.

Origins of the Strong Form Efficiency Concept

The strong form efficiency was developed by Burton G. Malkiel, a Princeton economics professor. He developed the concept in 1973 in his book titled "A Random Walk Down Wall Street." Practitioners of the strong form efficiency believe that public and inside information about the market that are revealed by stock prices will not give investors an edge in the market. That means that the information disclosed will not benefit investors or give them an advantage. Contained in the 1973 book by Burton G. Malkiel was also the semi-strong form efficiency in which public information about a market are revealed in current market prices.

Example of Strong Form Efficiency

It is important to emphasize that the strong form efficiency is the only version of the efficient market hypothesis that reveal insider information about the market, this is proprietary information. The information will not benefit an investor in terms of getting high returns as a result of the information revealed. For example, the chief technology officer (CTO) of a firm is fully aware that revealing proprietary information such as information about the internal development of rollout of a new product will jeopardize the standard rollout. According to strong form efficiency, if the information is revealed to the public after the product has been released, the stock price of the company will not be affected by the insider and public information revealed.

Related Articles

- Fed Balance Sheet - Explained

- Value of Marginal Product - Explained

- Duopoly - Explained

- Obligation Bond - Explained

Efficient Market Hypothesis (EMH)

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on July 12, 2023

Get Any Financial Question Answered

Table of contents, efficient market hypothesis (emh) overview.

The Efficient Market Hypothesis (EMH) is a theory that suggests financial markets are efficient and incorporate all available information into asset prices.

According to the EMH, it is impossible to consistently outperform the market by employing strategies such as technical analysis or fundamental analysis.

The hypothesis argues that since all relevant information is already reflected in stock prices, it is not possible to gain an advantage and generate abnormal returns through stock picking or market timing.

The EMH comes in three forms: weak, semi-strong, and strong, each representing different levels of market efficiency.

While the EMH has faced criticisms and challenges, it remains a prominent theory in finance that has significant implications for investors and market participants.

Types of Efficient Market Hypothesis

The Efficient Market Hypothesis can be categorized into the following:

Weak Form EMH

The weak form of EMH posits that all past market prices and data are fully reflected in current stock prices.

Therefore, technical analysis methods, which rely on historical data, are deemed useless as they cannot provide investors with a competitive edge. However, this form doesn't deny the potential value of fundamental analysis.

Semi-strong Form EMH

The semi-strong form of EMH extends beyond historical prices and suggests that all publicly available information is instantly priced into the market.

This includes financial statements, news releases, economic indicators, and other public disclosures. Therefore, neither technical analysis nor fundamental analysis can yield superior returns consistently.

Strong Form EMH

The most extreme version of EMH, the strong form, asserts that all information, both public and private, is fully reflected in stock prices.

Even insiders with privileged information cannot consistently achieve higher-than-average market returns. This form, however, is widely criticized as it conflicts with securities regulations that prohibit insider trading .

Assumptions of the Efficient Market Hypothesis

Three fundamental assumptions underpin the Efficient Market Hypothesis.

All Investors Have Access to All Publicly Available Information

This assumption holds that the dissemination of information is perfect and instantaneous. All market participants receive all relevant news and data about a security or market simultaneously, and no investor has privileged access to information.

All Investors Have a Rational Expectation

In EMH, it is assumed that investors collectively have a rational expectation about future market movements. This means that they will act in a way that maximizes their profits based on available information, and their collective actions will cause securities' prices to adjust appropriately.

Investors React Instantly to New Information

In an efficient market, investors instantaneously incorporate new information into their investment decisions. This immediate response to news and data leads to swift adjustments in securities' prices, rendering it impossible to "beat the market."

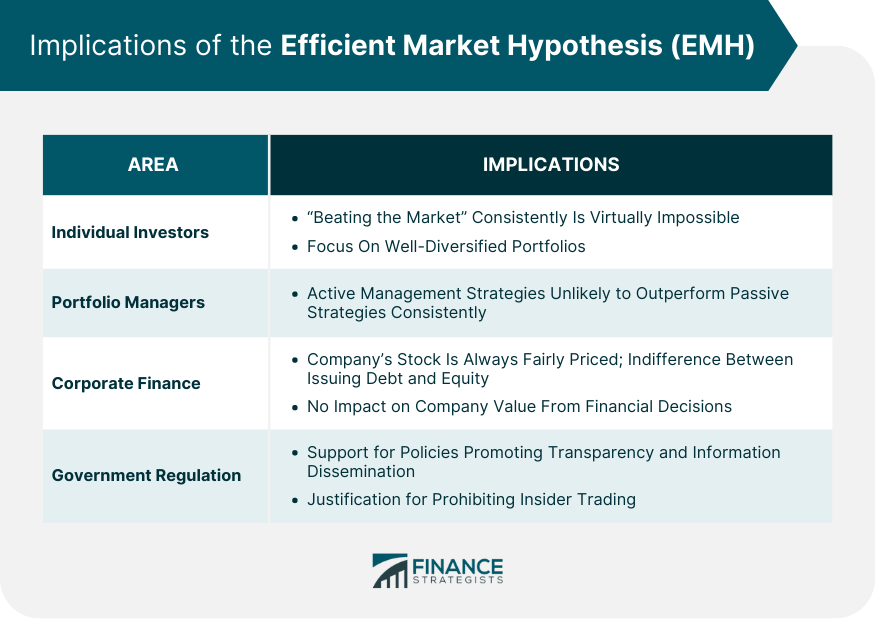

Implications of the Efficient Market Hypothesis

The EMH has several implications across different areas of finance.

Implications for Individual Investors

For individual investors, EMH suggests that "beating the market" consistently is virtually impossible. Instead, investors are advised to invest in a well-diversified portfolio that mirrors the market, such as index funds.

Implications for Portfolio Managers

For portfolio managers , EMH implies that active management strategies are unlikely to outperform passive strategies consistently. It discourages the pursuit of " undervalued " stocks or timing the market.

Implications for Corporate Finance

In corporate finance, EMH implies that a company's stock is always fairly priced, meaning it should be indifferent between issuing debt and equity . It also suggests that stock splits , dividends , and other financial decisions have no impact on a company's value.

Implications for Government Regulation

For regulators , EMH supports policies that promote transparency and information dissemination. It also justifies the prohibition of insider trading.

Criticisms and Controversies Surrounding the Efficient Market Hypothesis

Despite its widespread acceptance, the EMH has attracted significant criticism and controversy.

Behavioral Finance and the Challenge to EMH

Behavioral finance argues against the notion of investor rationality assumed by EMH. It suggests that cognitive biases often lead to irrational decisions, resulting in mispriced securities.

Examples include overconfidence, anchoring, loss aversion, and herd mentality, all of which can lead to market anomalies.

Market Anomalies and Inefficiencies

EMH struggles to explain various market anomalies and inefficiencies. For instance, the "January effect," where stocks tend to perform better in January, contradicts the EMH.

Similarly, the "momentum effect" suggests that stocks that have performed well recently tend to continue performing well, which also challenges EMH.

Financial Crises and the Question of Market Efficiency

The Global Financial Crisis of 2008 raised serious questions about market efficiency. The catastrophic market failure suggested that markets might not always price securities accurately, casting doubt on the validity of EMH.

Empirical Evidence of the Efficient Market Hypothesis

Empirical evidence on the EMH is mixed, with some studies supporting the hypothesis and others refuting it.

Evidence Supporting EMH

Several studies have found that professional fund managers, on average, do not outperform the market after accounting for fees and expenses.

This finding supports the semi-strong form of EMH. Similarly, numerous studies have shown that stock prices tend to follow a random walk, supporting the weak form of EMH.

Evidence Against EMH

Conversely, other studies have documented persistent market anomalies that contradict EMH.

The previously mentioned January and momentum effects are examples of such anomalies. Moreover, the occurrence of financial bubbles and crashes provides strong evidence against the strong form of EMH.

Efficient Market Hypothesis in Modern Finance

Despite criticisms, the EMH continues to shape modern finance in profound ways.

EMH and the Rise of Passive Investing

The EMH has been a driving force behind the rise of passive investing. If markets are efficient and all information is already priced into securities, then active management cannot consistently outperform the market.

As a result, many investors have turned to passive strategies, such as index funds and ETFs .

Impact of Technology on Market Efficiency

Advances in technology have significantly improved the speed and efficiency of information dissemination, arguably making markets more efficient. High-frequency trading and algorithmic trading are now commonplace, further reducing the possibility of beating the market.

Future of EMH in Light of Evolving Financial Markets

While the debate over market efficiency continues, the growing influence of machine learning and artificial intelligence in finance could further challenge the EMH.

These technologies have the potential to identify and exploit subtle patterns and relationships that human investors might miss, potentially leading to market inefficiencies.

The Efficient Market Hypothesis is a crucial financial theory positing that all available information is reflected in market prices, making it impossible to consistently outperform the market. It manifests in three forms, each with distinct implications.

The weak form asserts that all historical market information is accounted for in current prices, suggesting technical analysis is futile.

The semi-strong form extends this to all publicly available information, rendering both technical and fundamental analysis ineffective.

The strongest form includes even insider information, making all efforts to beat the market futile. EMH's implications are profound, affecting individual investors, portfolio managers, corporate finance decisions, and government regulations.

Despite criticisms and evidence of market inefficiencies, EMH remains a cornerstone of modern finance, shaping investment strategies and financial policies.

Efficient Market Hypothesis (EMH) FAQs

What is the efficient market hypothesis (emh), and why is it important.

The Efficient Market Hypothesis (EMH) is a theory suggesting that financial markets are perfectly efficient, meaning that all securities are fairly priced as their prices reflect all available public information. It's important because it forms the basis for many investment strategies and regulatory policies.

What are the three forms of the Efficient Market Hypothesis (EMH)?

The three forms of the EMH are the weak form, semi-strong form, and strong form. The weak form suggests that all past market prices are reflected in current prices. The semi-strong form posits that all publicly available information is instantly priced into the market. The strong form asserts that all information, both public and private, is fully reflected in stock prices.

How does the Efficient Market Hypothesis (EMH) impact individual investors and portfolio managers?

According to the EMH, consistently outperforming the market is virtually impossible because all available information is already factored into the prices of securities. Therefore, it suggests that individual investors and portfolio managers should focus on creating well-diversified portfolios that mirror the market rather than trying to beat the market.

What are some criticisms of the Efficient Market Hypothesis (EMH)?

Criticisms of the EMH often come from behavioral finance, which argues that cognitive biases can lead investors to make irrational decisions, resulting in mispriced securities. Additionally, the EMH has difficulty explaining certain market anomalies, such as the "January effect" or the "momentum effect." The occurrence of financial crises also raises questions about the validity of EMH.

How does the Efficient Market Hypothesis (EMH) influence modern finance and its future?

Despite criticisms, the EMH has profoundly shaped modern finance. It has driven the rise of passive investing and influenced the development of many financial regulations. With advances in technology, the speed and efficiency of information dissemination have increased, arguably making markets more efficient. Looking forward, the growing influence of artificial intelligence and machine learning could further challenge the EMH.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- AML Regulations for Cryptocurrencies

- Advantages and Disadvantages of Cryptocurrencies

- Aggressive Investing

- Asset Management vs Investment Management

- Becoming a Millionaire With Cryptocurrency

- Burning Cryptocurrency

- Cheapest Cryptocurrencies With High Returns

- Complete List of Cryptocurrencies & Their Market Capitalization

- Countries Using Cryptocurrency

- Countries Where Bitcoin Is Illegal

- Crypto Investor’s Guide to Form 1099-B

- Cryptocurrency Airdrop

- Cryptocurrency Alerting

- Cryptocurrency Analysis Tool

- Cryptocurrency Cloud Mining

- Cryptocurrency Risks

- Cryptocurrency Taxes

- Depth of Market

- Digital Currency vs Cryptocurrency

- Fiat vs Cryptocurrency

- Fundamental Analysis in Cryptocurrencies

- Global Macro Hedge Fund

- Gold-Backed Cryptocurrency

- How to Buy a House With Cryptocurrencies

- How to Cash Out Your Cryptocurrency

- Inventory Turnover Rate (ITR)

- Largest Cryptocurrencies by Market Cap

- Pros and Cons of Asset-Liability Management

- Types of Fixed Income Investments

Ask a Financial Professional Any Question

Discover wealth management solutions near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

- Search Search Please fill out this field.

What Is Market Efficiency?

Market efficiency explained, differing beliefs of an efficient market, an example of an efficient market.

- Fundamental Analysis

Market Efficiency Explained: Differing Opinions and Examples

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

Investopedia / Daniel Fishel

Market efficiency refers to the degree to which market prices reflect all available, relevant information. If markets are efficient, then all information is already incorporated into prices, and so there is no way to "beat" the market because there are no undervalued or overvalued securities available.

The term was taken from a paper written in 1970 by economist Eugene Fama, however Fama himself acknowledges that the term is a bit misleading because no one has a clear definition of how to perfectly define or precisely measure this thing called market efficiency. Despite such limitations, the term is used in referring to what Fama is best known for, the efficient market hypothesis (EMH) .

The EMH states that an investor can't outperform the market, and that market anomalies should not exist because they will immediately be arbitraged away. Fama later won the Nobel Prize for his efforts. Investors who agree with this theory tend to buy index funds that track overall market performance and are proponents of passive portfolio management.

Key Takeaways

- Market efficiency refers to how well current prices reflect all available, relevant information about the actual value of the underlying assets.

- A truly efficient market eliminates the possibility of beating the market, because any information available to any trader is already incorporated into the market price.

- As the quality and amount of information increases, the market becomes more efficient reducing opportunities for arbitrage and above market returns.

At its core, market efficiency is the ability of markets to incorporate information that provides the maximum amount of opportunities to purchasers and sellers of securities to effect transactions without increasing transaction costs. Whether or not markets such as the U.S. stock market are efficient, or to what degree, is a heated topic of debate among academics and practitioners.

There are three degrees of market efficiency. The weak form of market efficiency is that past price movements are not useful for predicting future prices. If all available, relevant information is incorporated into current prices, then any information relevant information that can be gleaned from past prices is already incorporated into current prices. Therefore future price changes can only be the result of new information becoming available.

Based on this form of the hypothesis, such investing strategies such as momentum or any technical-analysis based rules used for trading or investing decisions should not be expected to persistently achieve above normal market returns. Within this form of the hypothesis there remains the possibility that excess returns might be possible using fundamental analysis. This point of view has been widely taught in academic finance studies for decades, though this point of view is no long held so dogmatically.

The semi-strong form of market efficiency assumes that stocks adjust quickly to absorb new public information so that an investor cannot benefit over and above the market by trading on that new information. This implies that neither technical analysis nor fundamental analysis would be reliable strategies to achieve superior returns, because any information gained through fundamental analysis will already be available and thus already incorporated into current prices. Only private information unavailable to the market at large will be useful to gain an advantage in trading, and only to those who possess the information before the rest of the market does.

The strong form of market efficiency says that market prices reflect all information both public and private, building on and incorporating the weak form and the semi-strong form. Given the assumption that stock prices reflect all information (public as well as private), no investor, including a corporate insider, would be able to profit above the average investor even if he were privy to new insider information.

Investors and academics have a wide range of viewpoints on the actual efficiency of the market, as reflected in the strong, semi-strong, and weak versions of the EMH. Believers in strong form efficiency agree with Fama and often consist of passive index investors. Practitioners of the weak version of the EMH believe active trading can generate abnormal profits through arbitrage, while semi-strong believers fall somewhere in the middle.

For example, at the other end of the spectrum from Fama and his followers are the value investors , who believe stocks can become undervalued, or priced below what they are worth. Successful value investors make their money by purchasing stocks when they are undervalued and selling them when their price rises to meet or exceed their intrinsic worth.

People who do not believe in an efficient market point to the fact that active traders exist. If there are no opportunities to earn profits that beat the market, then there should be no incentive to become an active trader. Further, the fees charged by active managers are seen as proof the EMH is not correct because it stipulates that an efficient market has low transaction costs.

While there are investors who believe in both sides of the EMH, there is real-world proof that wider dissemination of financial information affects securities prices and makes a market more efficient.

For example, the passing of the Sarbanes-Oxley Act of 2002 , which required greater financial transparency for publicly traded companies, saw a decline in equity market volatility after a company released a quarterly report. It was found that financial statements were deemed to be more credible, thus making the information more reliable and generating more confidence in the stated price of a security. There are fewer surprises, so the reactions to earnings reports are smaller. This change in volatility pattern shows that the passing of the Sarbanes-Oxley Act and its information requirements made the market more efficient. This can be considered a confirmation of the EMH in that increasing the quality and reliability of financial statements is a way of lowering transaction costs.

Other examples of efficiency arise when perceived market anomalies become widely known and then subsequently disappear. For instance, it was once the case that when a stock was added to an index such as the S&P 500 for the first time, there would be a large boost to that share's price simply because it became part of the index and not because of any new change in the company's fundamentals. This index effect anomaly became widely reported and known, and has since largely disappeared as a result. This means that as information increases, markets become more efficient and anomalies are reduced.

Fama, Eugene F. “ Efficient Capital Markets: A Review of Theory and Empirical Work .” The Journal of Finance , vol. 25, no 2, May 1970, pp. 383.

Chicago Booth Review. “ Eugene F. Fama, Efficient Markets, and the Nobel Prize .”

Fama, Eugene F. “ Efficient Capital Markets: A Review of Theory and Empirical Work .” The Journal of Finance , vol. 25, no 2, May 1970, pp. 388.

Fama, Eugene F. “ Efficient Capital Markets: A Review of Theory and Empirical Work .” The Journal of Finance , vol. 25, no 2, May 1970, pp. 404-405.

Fama, Eugene F. “ Efficient Capital Markets: A Review of Theory and Empirical Work .” The Journal of Finance , vol. 25, no 2, May 1970, pp. 409-410.

Wolla, Scott A. “ Stock Market Strategies: Are You an Active or Passive Investor? ” Federal Reserve Bank of St. Louis , April 2016, p. 3.

Chlikani, Surya, and D’Souza, Frank. “ The Impact of Sarbanes-Oxley on Market Efficiency: Evidence from Mergers and Acquisitions Activity .” The International Journal of Business and Finance Research , vol. 5, no 4, 2011, p. 75.

National Bureau of Economic Research. “ Stock Price Reactions to Index Inclusion .”

:max_bytes(150000):strip_icc():format(webp)/usa-stock-market-crash-827585890-bb854fc8911b4026990b0152db976fd6.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Financial Tips, Guides & Know-Hows

Home > Finance > Semi-Strong Form Efficiency: Definition And Market Hypothesis

Semi-Strong Form Efficiency: Definition And Market Hypothesis

Published: January 26, 2024

Learn about semi-strong form efficiency in finance and understand its definition and market hypothesis. Discover how it impacts investment decisions.

- Definition starting with S

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

Semi-Strong Form Efficiency: Definition and Market Hypothesis Explained

Welcome to our finance blog post where we delve into the fascinating world of market efficiency. In particular, we are going to explore the concept of Semi-Strong Form Efficiency, a fundamental theory in finance. Have you ever wondered whether the stock market truly reflects all available information? What impact do public announcements or news events have on stock prices? We will uncover the answers to these questions and more in this article.

Key Takeaways:

- Semi-Strong Form Efficiency suggests that stock prices already incorporate all publicly available information.

- Efficient market hypothesis states that it is impossible to consistently achieve above-average market returns using only publicly available information.

What is Semi-Strong Form Efficiency?

Semi-Strong Form Efficiency is a concept that forms a significant part of the Efficient Market Hypothesis. It posits that stock prices accurately reflect all publicly available information. This means that analyzing historical market data or relying on recent news events will not provide an edge in generating consistent and above-average returns.

The theory of Semi-Strong Form Efficiency suggests that stocks adjust so quickly and accurately to new information that it becomes virtually impossible for investors to outperform the market based solely on publicly available information. Investors who attempt to beat the market by analyzing news events, company announcements, or financial statements are unlikely to consistently outperform the overall market in the long run.

To better understand this concept, let’s consider an example. Suppose a company releases its quarterly earnings report, which beats market expectations. In an environment of Semi-Strong Form Efficiency, this positive news will be quickly incorporated into the stock price. By the time the information becomes widely available, the stock price will already reflect the positive market sentiment, making it difficult for investors to profit solely from this news.

So, how does Semi-Strong Form Efficiency fit into the broader Efficient Market Hypothesis?

The Efficient Market Hypothesis (EMH) is a theory that states financial markets are efficient and that it is impossible to consistently achieve above-average market returns using only publicly available information. EMH classifies market efficiency into three forms: weak, semi-strong, and strong.

Semi-Strong Form Efficiency lies in the middle of these three forms. It posits that not only are stock prices influenced by past market data (weak form), but they also reflect all publicly available information (semi-strong form). In its strongest form, market efficiency theory suggests that stock prices also incorporate private or insider information that is not available to the public.

The Implications of Semi-Strong Form Efficiency

The theory of Semi-Strong Form Efficiency has several implications for investors:

- Efficient Market Hypothesis Challenges Active Management: As the Efficient Market Hypothesis suggests that investors cannot consistently outperform the market based on publicly available information, proponents argue that active stock picking and market timing are unlikely to lead to superior returns. This challenges the idea that professional fund managers or individual investors can beat the market consistently.

- Focus on Other Investment Strategies: In light of Semi-Strong Form Efficiency, many investors turn to other strategies that do not rely solely on publicly available information. These strategies include passive investing (such as index fund investing) and alternative investment vehicles like private equity or hedge funds that may have access to additional information sources.

- Importance of Fundamental Analysis: Although Semi-Strong Form Efficiency suggests that analyzing publicly available information may not consistently yield above-average returns, it does not render fundamental analysis useless. Understanding a company’s financials, industry trends, and competitive advantages can still provide valuable insights for long-term investment decision making and risk management.

In conclusion, Semi-Strong Form Efficiency is a critical concept within the field of finance. By acknowledging that stock prices efficiently reflect all publicly available information, investors can make more informed decisions and shape their investment strategies accordingly. While it challenges the ability to consistently outperform the market using publicly available data, it highlights the importance of alternative investment strategies and a comprehensive understanding of fundamental analysis.

20 Quick Tips To Saving Your Way To A Million Dollars

Our Review on The Credit One Credit Card

Voodoo Accounting Definition

What Is MMN In Banking

Latest articles.

Navigating Crypto Frontiers: Understanding Market Capitalization as the North Star

Written By:

Financial Literacy Matters: Here’s How to Boost Yours

Unlocking Potential: How In-Person Tutoring Can Help Your Child Thrive

Understanding XRP’s Role in the Future of Money Transfers

Navigating Post-Accident Challenges with Automobile Accident Lawyers

Related post.

By: • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/semi-strong-form-efficiency-definition-and-market-hypothesis/

IMAGES

VIDEO

COMMENTS

Strong form efficiency is the strongest version of market efficiency and states that all information in a market, whether public or private, is accounted for in a stock's price. Practitioners of ...

Semi-Strong Form Efficiency: Definition and Market Hypothesis Semi-strong form efficiency is a form of Efficient Market Hypothesis (EMH) assuming stock prices include all public information. more

Aspirin Count Theory: A market theory that states stock prices and aspirin production are inversely related. The Aspirin count theory is a lagging indicator and actually hasn't been formally ...

The efficient market hypothesis (EMH) theorizes about the relationship between the: Under the efficient market hypothesis, following the release of new information/data to the public markets, the prices will adjust instantaneously to reflect the market-determined, "accurate" price. EMH claims that all available information is already ...

Strong form efficient market hypothesis followers believe that all information, both public and private, is incorporated into a security's current price. In this way, not even insider ...

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information. ... Semi-strong form tests study ...

Strong Form EMH: Strong form EMH says that all information, both public and private, is priced into stocks; therefore, no investor can gain advantage over the market as a whole. Strong form EMH does not say it's impossible to get an abnormally high return. That's because there are always outliers included in the averages.

Efficient market definition. An efficient market is where all asset prices listed on exchanges fully reflect their true and only value, ... Example of a semi-strong form efficient market hypothesis. Let's assume that 'stock X' is trading at $40 per share and is about to release its quarterly financial results. In addition, there was some ...

The efficient-market hypothesis says that financial markets are effective in processing and reflecting all available information with little or no waste, making it impossible for investors to consistently outperform the market based on information already known to the public. One area of debate is how strong the efficient-market hypothesis is.

Understanding strong form efficiency. Strong form efficiency, a key tenet of the efficient market hypothesis (EMH), asserts that all information, public or private, is already accounted for in a stock's price. In the realm of market efficiency theories, strong form stands as the most stringent, suggesting that even insider information confers ...

Semi-Strong Form Efficiency: Definition and Market Hypothesis Semi-strong form efficiency is a form of Efficient Market Hypothesis (EMH) assuming stock prices include all public information. more

Financial economists have devised three forms of market efficiency from an information perspective: weak form, semi-strong form, and strong form. ... These three forms constitute the efficient market hypothesis. Believers in these three forms of efficient markets maintain, in varying degrees, that it is pointless to search for undervalued ...

Strong Form Efficiency is a pricing efficiency that assumes that a security's price reflects all information irrespective of whether they are publicly available or not. It states that no investor can gain excess returns. Legal barriers to private information publication, like insider trading laws, hinder strong-form efficiency.

An efficient market is one where the market price is an unbiased estimate of the true value of the investment. Implicit in this derivation are several key concepts - (a) Contrary to popular view, market efficiency does not require that the market price be equal to true value at every point in time.

Efficient Market Theory is a cornerstone of financial economics, positing that financial markets are efficient and that asset prices reflect all available information. The concept has significant implications for investment decision-making, portfolio management, and market regulation. However, the debate surrounding EMT remains ongoing, with ...

Strong Form Market Efficiency. Strong form of market efficiency is when prices already reflect both publically available information and inside information. In strong form of market efficiency, it is not possible to earn access return by any means. Strong form of market efficiency is the strongest form of efficient market hypothesis, stronger ...

Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it private or public. In strong form efficiency, stock prices reflect public and private information about a market. Strong form efficiency is the strongest of the three forms of the efficient market hypothesis.

The Efficient Market Hypothesis is a crucial financial theory positing that all available information is reflected in market prices, making it impossible to consistently outperform the market. It manifests in three forms, each with distinct implications. The weak form asserts that all historical market information is accounted for in current ...

The Efficient Market Hypothesis (EMH) states that the stock prices show all pertinent details. This information is shared globally, making it impossible for investors to gain above-average returns constantly. Behavioral economists or others who believe in the market's inherent inefficiencies criticize the theory assumptions highly.

Semi-Strong Form Efficiency: Definition and Market Hypothesis Semi-strong form efficiency is a form of Efficient Market Hypothesis (EMH) assuming stock prices include all public information. more